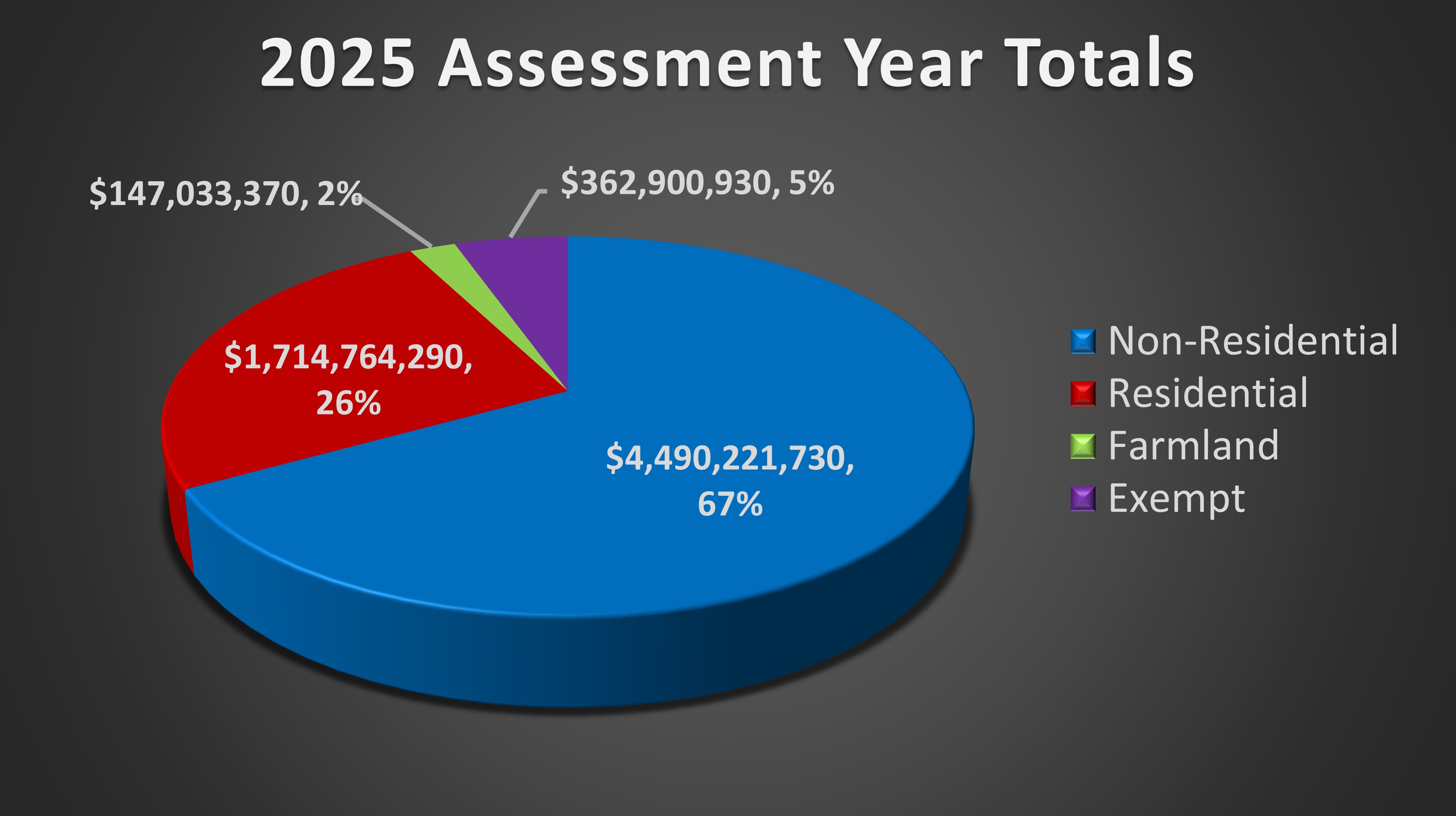

The Cypress County assessment department prepares assessments for properties on an annual basis in accordance with legislative requirements. The entire assessment base of Cypress County is around $6.7 billion. A pie chart depicting the various property types assessed in Cypress County can be observed below:

Farmland, machinery & equipment, and certain non-residential properties are assessed at regulated rates which are derived from provincial legislation and regulation. Residential, small business, and certain non-residential properties are assessed based on their market value using recent comparable sales of similar properties. The 2025 comparable sales sheet as well as a market land model map and other assessment information can be observed in the main folder below.

What you need to know

Cypress County issues property assessment notices at the beginning of each year, which begins a 67-day assessment complaint period. During this time, we encourage you to review your assessment details and contact assessment if you have any questions or comments. We are committed to providing reliable information and service that you can count on.

* If you received an amended assessment notice then your date range will be different. You will still have a 67-day assessment complaint period, but it will be based on the date of your amended notice.

How are taxes calculated?

- Assessors prepare the assessments.

- Cypress County council sets the tax rate.

- Once council approves an annual budget to operate their municipality, the revenue required is divided by the municipality’s assessment base.

Step 1: Review your assessment notice

Step 2: Talk to us during the assessment complaint period

The assessment complaint period is the time we dedicate to working with you to review your property assessment. Here is what you can expect when you call assessment:

What we will do: Verify and confirm information about your property with you.

What you can do: Update us on your property.

What we will do: If inconsistencies are found, we'll explain what we need to verify and correct the information. Confirmed inconsistencies will be corrected.

What you can do: Learn more about how your property was assessed.

What we will do: Share how your property assessment was determined.

What can you do: Show us comparable properties you found in assessment search.

What we will do: We will look at the different properties that may have been used as comparable properties, including ones that you may have identified in your own research.

What you can do: Make an appointment with an assessor to discuss your property in depth. This can be done in-person or on the phone, depending on your preference. There is no cost for appointments.

What we will do: Discuss variables which may have influenced your property value.

What you can do: If we cannot come to a consensus about the assessment of your property, we'll help you understand how to appeal your assessment with the Assessment Review Board.

What we will do: Answer your question in an honest, transparent and respectful manner.

What you can do: Share your questions and comments with us. We're happy to listen and help if we can.

Step 3: Assessment Review Board: What to do if we can't reach an agreement

If we are unable to come to a consensus about the assessment of your property, there is a mechanism in place to help reach a conclusion. You may file a complaint with the Assessment Review Board (ARB). The ARB is an impartial tribunal that hears and resolves assessment complaints by property owners. A complaint may be filed no later than the final date noted on the front of the assessment notice. You cannot appeal your tax notice (bill), only the assessment of your property (assessment notice).

If you choose to file a complaint, your hearing date will be provided to you by the ARB. It is suggested that you gather and prepare the evidence you wish to provide even before you have been given a hearing date. This is an important task as you will need to provide evidence which supports your determination that your assessment is incorrect.

A valid assessment complaint form must be accompanied by the required filing fee indicated on the front of the assessment notice. When speaking with us (before making a complaint to ARB) we will provide you with a brief, general summary of the steps you will need to follow to file a complaint with ARB. For more information please review MATTERS RELATING TO ASSESSMENT COMPLAINTS REGULATION.

If Canada Post has recently changed your mailing address, or you have moved, remember to update your information to ensure continued delivery of your assessment and tax notices.

- Through the online form

- In person at the county office

There are two options to update your property tax address with Cypress County:

You should also update your address with the land titles office to ensure your correct mailing address is recorded on the certificate of title. Visit Service Alberta for more information.